Ras Al Khaimah is a fast developing city and emirate, situated against the backdrop of the Al Hajar Mountain Range, in the north of the UAE. It is one of the greatly developed Emirates of UAE offering very attractive and secure tax and legal environment for international business.

RAK International Corporate Centre (RAK ICC) is a United Arab Emirates Corporate Registry operating in Ras Al Khaimah. RAKICC is responsible for the registration and incorporation of International Business Companies. As well as providing a full suite of Registry services related to International Business company activity.

THE RAKICC FOUNDATION:

The Ras Al Khaimah International Corporate Centre (RAK ICC) has announced the launch of its Foundation regime and has finalised the details in the RAK ICC Foundations Regulations 2019. These regulations make provisions for the registration of a Foundation established by a founder to dedicate certain assets towards specified charitable or non-charitable purposes.

The Foundation will have a separate legal personality, and the regulations are the result of global bench-marking to ensure they meet the appropriate international standards and market requirements. They can be used for a number of purposes, including but not limited to, financial structuring, succession and tax planning, private wealth management and preservation, asset protection, and by charitable institutions.

Advantages of RAK ICC FOUNDATION:

- Distinct legal personality that separates liability whilst maintaining control of assets

- Have perpetual existence after the lifetime of the founders.

- Provide a robust governance structure

- Removal of assets from the ownership of the founder in connection with potential liability in the future.

- Flexibility with beneficial class

- Suitable for inheritance planning and holding of family assets

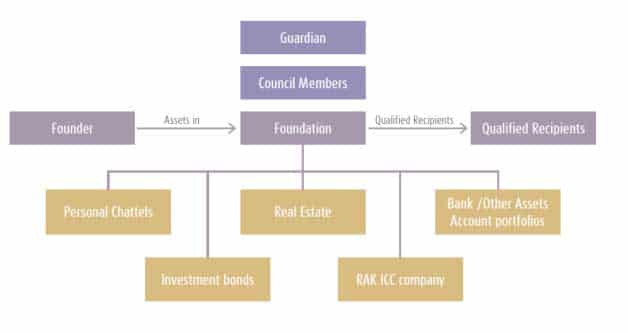

Possible RAK ICC Foundation Structure

Key Features of the RAK ICC FOUNDATION:

- Governing Law:

The RAK ICC Foundations Regulations 2019 - Minimum Initial Capital:

The minimum initial capital to register a RAK ICC Foundation is USD 100 or its equivalent in any currency. Additional property may be subsequently contributed to the Foundation by a Contributor. - The Founder:

The Founder of a RAK ICC Foundation is the one who creates and funds the Foundation and can be an individual or a corporate body. - Foundation Council Members:

The Council of a RAK ICC Foundation is comprised of a minimum 2 Members who could be either the Founder, Family Members, Trusted Advisors, Professional Advisers and can be an individual or a corporate body. - The Guardian:

The Guardian supervises the Council Members and ensures strict compliance with the By-Laws of the RAK ICC Foundation at all times. - The Designee:

The Designee is recipient to whom all property of a Foundation for which provision has not otherwise been made shall pass in the event of the termination thereof. - The Qualified Recipient:

A qualified recipient is a person who is entitled to receive an amount of the RAK ICC Foundation in accordance with the Charter or the By-Laws. - Confidentiality of a RAK ICC Foundation:

The Registrar shall maintain a Foundations Register which shall contain basic details of each Foundation (name and date of registration, details of the Founder, Council Members, and Registered Agent). All other information is treated as private and shall not be disclosed unless so required by relevant authority. - Annual Accounts:

The Accounting Records of a RAK ICC Foundation shall be maintained by the Registered Agent at the Registered Office and are not subject to public disclosure. - Renewal:

Renewals for RAK ICC Foundation falls every anniversary date of incorporation. Failure to do so results in penalties and could result in the striking-off of the foundation from the Foundation Registry.

Latest valid passport copy and recent utility for address proof of Protector, Foundation Council Members and Beneficiaries are required to be submitted every renewal of the Foundation as a part of enhanced due diligence. - Requirements in Setting Up a RAK ICC Foundation:

- Duly filled application form

- Notarized Passport copy with photo & signature of the Founder

- Bank reference in English Language and not older than 3 months

- Professional Reference in English Language and not older than 3 months

- Details of designee and qualified recipients, their share & passport copies

- Names of Foundation Council Members, their powers, passport copies & address proof.

- Name of Guardian, passport copies, their proof of existence / address.

- Duly filled Fatca Form

- Notarized US Declaration (if US Person)

Incorporation of a RAK ICC FOUNDATION begins from AED 9,915/-

Global Business Services DMCC has helped many individuals and corporate entities to set up a RAK ICC FOUNDATION. Our Company acts as a one stop solution for RAKICC Foundation incorporation services.

If you are looking for RAK ICC FOUNDATION set up, please get in touch with us for professional assistance.

FAQ’s on RAK ICC Foundation

- Can Founder of a RAK ICC FOUNDATION be a corporate body:

Yes, the Founder can be an individual or corporate body. - Can Founder of RAK ICC FOUNDATION be a Guardian or Beneficiary:

Yes, the Founder can be either a Guardian or Beneficiary. - Can the beneficiary of a RAK ICC FOUNDATION be the Guardian:

Yes, the Guardian can be a Beneficiary. But a Guardian cannot be a member of the Foundation Council. - Can the beneficiary of a RAK ICC FOUNDATION be a member of Foundation Council:

Yes, a Beneficiary can be a member of the Foundation Council. - How many members required in Foundation Council:

Every RAK ICC Foundation shall have council which shall consist of minimum two members. - Can Guardian RAK ICC FOUNDATION revoke the Foundation if it is provided in the Foundation Charter:

Yes. - Can Guardian RAK ICC FOUNDATION amend beneficiaries:

Yes, the Protector can include or exclude Beneficiaries. It can also indicate conditions for the Beneficiaries to enjoy the Foundation’s patrimony. We can also limit that only the First Protector of the Foundation has the before-mentioned faculties, and that Alternate or Secondary Protectors cannot include or exclude Beneficiaries. - Can Founder of a RAK ICC FOUNDATION change Protector or can it be restricted:

Yes, this can be restricted. - Can Guardian of a RAK ICC FOUNDATION be also authorised attorney given General POA for management of assets of the Foundation:

Yes, the Foundation can issue a General Power of Attorney in favor of the Guardian.

Whilst every effort has been made to ensure that the details contained herein are correct and up-to-date, it does not constitute legal, tax or other professional advice. We do not accept any responsibility, legal or otherwise, for any errors or omissions.