About Jebel Ali Free Zone (JAFZA):

Jebel Ali Free Zone is a free economic zone located in the Jebel Ali area at the far western end of Dubai. A leading Free Zone of the region that lies at the centre of trade and is part of a unique ecosystem that offers end to end solutions and growth opportunities to businesses that operate locally and globally.

In over 3 decades, Jafza grew from 19 companies in 1985 to more than 500 in 1995, and over 8,000 today, which includes nearly 100 Global Fortune 500 enterprises. Most of these companies have set up their regional headquarters in Jafza to serve the wider Middle East region comprising West Asia, the CIS, Africa and Indian Subcontinent.

Today, Jafza proudly stands as a dynamic base for thousands of businesses from over 100 countries, sustains more than 135,000 jobs and attracts 23.9% of Dubai’s foreign direct investment.

In 2003, Jebel Ali Free Zone Authority (JAFZA) which manages one of the largest free zone in the region, promulgated JAFZA Offshore Companies Regulation which permits setting up of an offshore company.

- 100% Foreign Ownership

- Conducting business without corporate/personal taxes

- Conducting business as an international entity

- Open bank accounts locally and internationally

- Protecting investments in other foreign countries

- Easy transfer of capital and profits

- Complete anonymity and privacy

- Transfer of domiciliation of Continuation

- Can own property in Dubai & No requirement of local sponsor

- Conversion to JAFZA Free-zone is allowed

- Fast Incorporation & Re-domicile is allowed

Limitations of JAFZA Offshore Company:

- Cannot carry out business (or provide services) with a UAE based customer/supplier

- Cannot have a physical office

- Cannot sponsor UAE residence visas for employees/directors/shareholder

- Not entitled to tax residency certificate

JAFZA Offshore Setup Process:

Step 1:

Identify the propose structure and activity of the company

Step 2:

KYC and compliance checking

Step 3:

Apply in Dubai Trade Portal and preparation of documents

Step 4:

Payment of relevant fees to the authority

Step 5:

Signing and Filing of application forms with JAFZA Offshore Authority

Step 6:

JAFZA Criminal Investigation Department (CID) approval

Step 7:

JAFZA Offshore department approval for incorporation

Step 8:

Issuance of Certificate of Incorporation and M&AA

Documents required for JAFZA Company Setup:

For Individual Directors, Shareholders and Ultimate Beneficial Owners:

- Passport and Visa page/ entry stamp in UA

- Original utility bill or local authority tax bill not older than 3 months old

- Bank Reference Letter not older than 3 months old

- CV/Profile

- Fatca Forms/UBO Declarations

For Corporate Shareholders (attested upto UAE MOFA):

- Company Documents (Certificate of Registration, M&AA, Registers etc.)

- Certificate of Good Standing

- Certificate of Incumbency

- Attested Resolution approving the incorporation of the JAFZA Offshore Company

JAFZA Offshore Company Formation Cost:

JAFZA Incorporation fee is AED 10,040/- excluding Professional Fees and Annual registered agent fees on fulfillment of JAFZA requirements

How can GBS help?

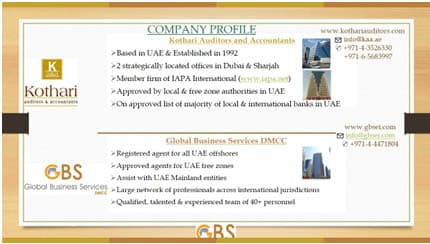

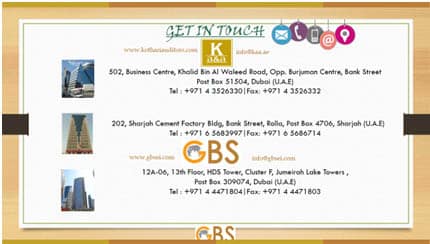

Global Business Services (GBS) is a professional organization that offers advisory, commercial, accounting, company formation & administration services in tax efficient jurisdictions around the world. The team at GBS has since inception, developed an excellent understanding of corporate requirements. We are known in the market to provide a higher standard of company setup guidance – without higher costs. We provide a free consultation that will help answer every question you may have about setting up a company in the UAE.

For more information on JAFZA company formation , do get in touch with us on +971 55 564 3058 or email us at info@gbsei.com

Whilst every effort has been made to ensure that the details contained herein are correct and up-to-date, it does not constitute legal, tax or other professional advice. We do not accept any responsibility, legal or otherwise, for any errors or omissions. We also suggest that independent legal, tax, professional advice be obtained by the user of this information before proceeding with incorporation.