Table of Contents

- What is a Mainland Company in Dubai?

- What is a Free Zone Company in Dubai?

- What is an Offshore Company in Dubai?

- Mainland vs Free Zone vs Offshore Business Setup

- FAQs

- Conclusion

Planning to start a business in the UAE? Your first big decision is legal jurisdiction – Mainland, Free Zone or Offshore. And that choice determines ownership, tax treatment, market access and setup cost. This guide breaks down each option, real use-cases and a one-line recommendation so you can pick the right setup fast.

What is a Mainland Company in Dubai?

Mainland company formation services allow businesses to operate anywhere within the UAE and can directly connect with the local market. These companies are regulated by the UAE government and are permitted to conduct business within the UAE and internationally. For detailed information on setting up a Mainland company in Dubai, you can refer to the official guidelines provided by the Invest in Dubai portal.

Advantages of Mainland Company Formation:

- Access to the Local Market: Mainland companies can freely trade within the UAE and tap into local demand, making them ideal for businesses looking to target the UAE market.

- Full Flexibility in Business Operations: These companies can operate anywhere in the UAE, including government projects and tenders.

- No Restrictions on Business Activities: Mainland businesses are not limited in terms of the business activities they can conduct, offering a wide range of options.

- Choice of Business Location: Mainland businesses in Dubai can have office space anywhere in Dubai outside the free zone

Disadvantages of Mainland Company Formation:

Company formation in the Mainland has to deal with many government rules and approvals, which makes business setup complicated and slower than Free Zone companies. They also face stricter legal requirements, which means more paperwork and steps to follow.Certain businesses still require a UAE local sponsor/service agent.

How to Register a Business in Dubai Mainland

To register a business in Dubai Mainland, follow these steps:

- Select a Business Activity: Choose the type of business you wish to operate.

- Choose a Legal Structure: Select your company’s legal structure (LLC, sole proprietorship, etc.).

- Apply for a Trade Name: Choose and register your company name with the Department of Economic Development (DED).

- Get Necessary Approvals: Depending on your business, you may need approvals from specific government bodies.

- Obtain a Business License: Apply for your business license through the DED.

- Register with the Chamber of Commerce: Complete registration with the Dubai Chamber of Commerce for membership.

What is a Free Zone Company in Dubai?

A Free Zone company is established in one of the UAE’s many designated Free Zones, which are designed to attract foreign investors through tax exemptions and other incentives. With the guidance of free zone business setup consultants in Dubai, entrepreneurs can easily navigate the legal procedures, licensing, and compliance requirements. While Free Zone companies can operate internationally, they are restricted from trading directly within the UAE market unless they partner with a local distributor. For official details on establishing a business in Free Zones, visit the UAE Ministry of Economy’s Free Zone business setup guide.

Advantages of Free Zone Company Formation:

- 100% Foreign Ownership: Free Zone businesses can be 100% owned by foreign investors, with no need for a local sponsor.

- Tax Benefits: Many Free Zones offer corporate tax incentives (often long-term exemptions subject to meeting conditions specified by Corporate Tax Law), customs duty relief, and simplified VAT handling (in case of Designated Zones only & subject to conditions).

- Easy Setup and Administration: The process to set up a Free Zone company is typically faster and more straightforward compared to a Mainland setup.

- Full Repatriation of Profits: Investors can freely repatriate profits and capital to their home countries.

- Free Zone Company Formation is Best for: exporters, SaaS, consulting, holding companies and startups wanting 100% foreign ownership.

Note: VAT is a federal tax and generally applies to taxable supplies in the UAE, including supplies in a Free Zone; VAT treatment for Designated Zones (certain Free Zones) depends on various factors such as location of customer, movement of goods, etc. – specific professional advice to be sought from a tax advisor.

Disadvantages of Free Zone Company Formation:

Free Zone companies in the UAE can only do business within their specific Free Zone or internationally. Trade in the UAE should be carried out through a local supplier. The office of the company will be located within the free zone where the company is registered. Some Free Zones focus on certain industries, so businesses need to choose a Free Zone that matches their activities.

How to Register a Business in Dubai Free Zone

To register a business in Dubai Free Zone, follow these simple steps:

- Choose the Right Free Zone: Select a Free Zone that aligns with your business activities (e.g., tech, trade, media). Each Free Zone offers unique benefits based on industry needs.

- Apply for Necessary Licenses and Permits: Apply for the required business licenses (trade, professional, or industrial) and permits through the Free Zone authority.

- Lease Office Space: Secure office space or a virtual office.

- Obtain Employment Visas: Depending on your business size, apply for employee visas and permits to ensure legal employment within the Free Zone.

What is an Offshore Company in Dubai?

An Offshore company in Dubai is typically set up for businesses that are looking to conduct international trade, manage assets, or protect assets. Offshore companies are not allowed to conduct business within the UAE but can operate internationally. This setup is often favored by investors looking for privacy and low operational costs.

Advantages of Offshore Company Formation:

- Privacy and Confidentiality: Offshore companies provide a high level of confidentiality, with little to no public access to company information.

- Asset Protection: Offshore companies are commonly used for asset protection and wealth management due to the privacy they offer.

- Low Setup and Maintenance Costs:The setup costs for offshore companies are typically much lower compared to Mainland and Free Zone companies, with minimal government regulation.

Disadvantages of Offshore Company Formation:

Offshore company formations are limited to engaging in international trade, holding assets, and maintaining confidentiality. They are not permitted to conduct local retail or service activities. Offshore companies are not able to establish a physical office or hire employees within the UAE.

How to Set Up an Offshore Company in the UAE

Setting up an Offshore company in the UAE is relatively simple and can be done through a licensed agent. Here’s a step-by-step guide to get started:

- Choose a Jurisdiction: Select an Offshore jurisdiction, such as JAFZA or RAKEZ.

- Submit Required Documents: Provide identification documents, proof of address, and any relevant business details.

- Appoint Directors and Shareholders: Appoint the company’s directors and shareholders, typically individuals or corporate entities.

- Register Your Company: Submit your registration application and pay the associated fees.

- Obtain Bank Accounts: After registration, you’ll need to open a bank account for your Offshore company.

Mainland vs Free Zone vs Offshore Business Setup

Choosing the right setup for your business in the UAE depends on your specific needs. Here’s a quick comparison to help you make the best decision:

| Feature | Mainland | Free Zone | Offshore |

| Ownership | Local sponsor required for some businesses | 100% foreign ownership | 100% foreign ownership |

| Market Reach | Can operate anywhere in the UAE | Internationally & within the free zone. Sales in the UAE to be carried out through a local agent. | International only |

| Corporate Tax | Subject to 9% corporate tax | Subject to 9% corporate tax. Certain companies can claim 0% exemption, subject to meeting the necessary conditions | Subject to 9% corporate tax (could be eligible for exemption, subject to conditions) |

| Setup Process | Complex with longer processing times | Quick and easier to set up | Straightforward, often handled by agents |

| Costs | Higher setup and maintenance costs | Lower setup and operational costs | Low setup and maintenance costs |

| Scope of Business | Broad, with full flexibility | Industry-specific (limited scope) | International operations, no domestic trading |

| License Type | Commercial, Industrial & Professional licenses | Commercial, Service & Industrial licenses | Restricted Activities) |

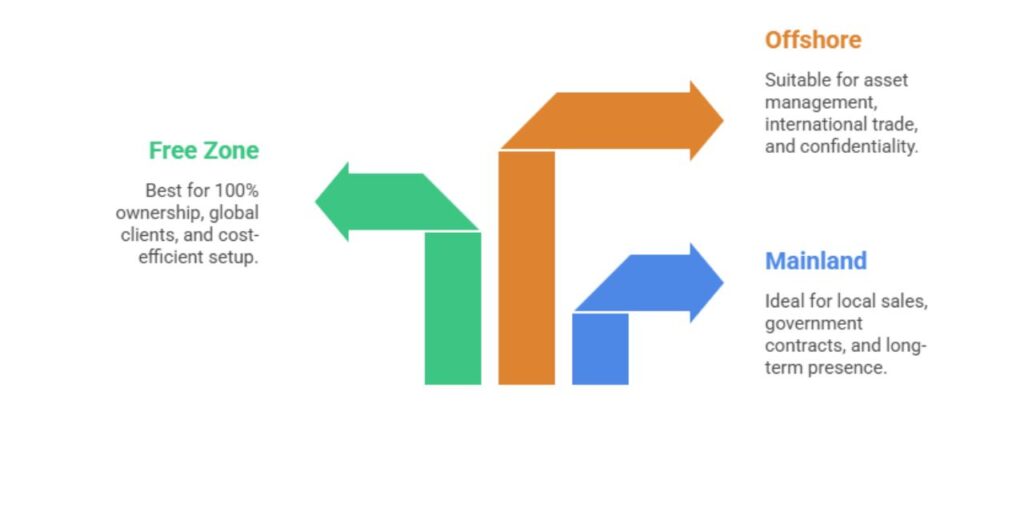

Which Business Setup Should I Choose in the UAE

When setting up a business in the UAE, you can choose from three options: Free Zone, Offshore, and Mainland. Free Zone allows 100% ownership and is the best option for global clients. Offshore businesses focused on asset management and privacy. Mainland is best for companies targeting local sales and government contracts. Each option serves different needs, helping you pick the one that aligns with your goals.

FAQs

What are the costs of registering a new business in the Dubai Mainland?

The costs depend on the type of business, legal structure, and the license required.

Can I switch from an Offshore company to a Free Zone or Mainland setup?

No, you cannot directly convert an Offshore company to a Free Zone or Mainland entity. You would need to establish a new legal entity under the desired jurisdiction and meet all its licensing and regulatory requirements.

How long does it take to register a business in the Dubai Mainland?

Typically 1–4 weeks depending on approvals and activity. Simple professional licenses may take under 2 weeks; regulated activities requiring ministry approvals can take longer.

Do I need a physical office for my Dubai Mainland business?

Yes, you are required to have a physical office space to operate in the Dubai Mainland. The office size depends on the type of business and the number of employees.

Conclusion

If you need to sell in the UAE without any restrictions -> Mainland.

If you want 100% ownership + export focus -> Free Zone

If you need asset protection and global holding -> Offshore

Need a custom recommendation? Connect with us and we’ll map the best jurisdiction, cost estimate and timeline for your business. With Global Business Services FCZO, a leading UAE business setup consultancy, we ensure you choose the right option for your business in the UAE.