British Virgin Islands (BVI) Business set up

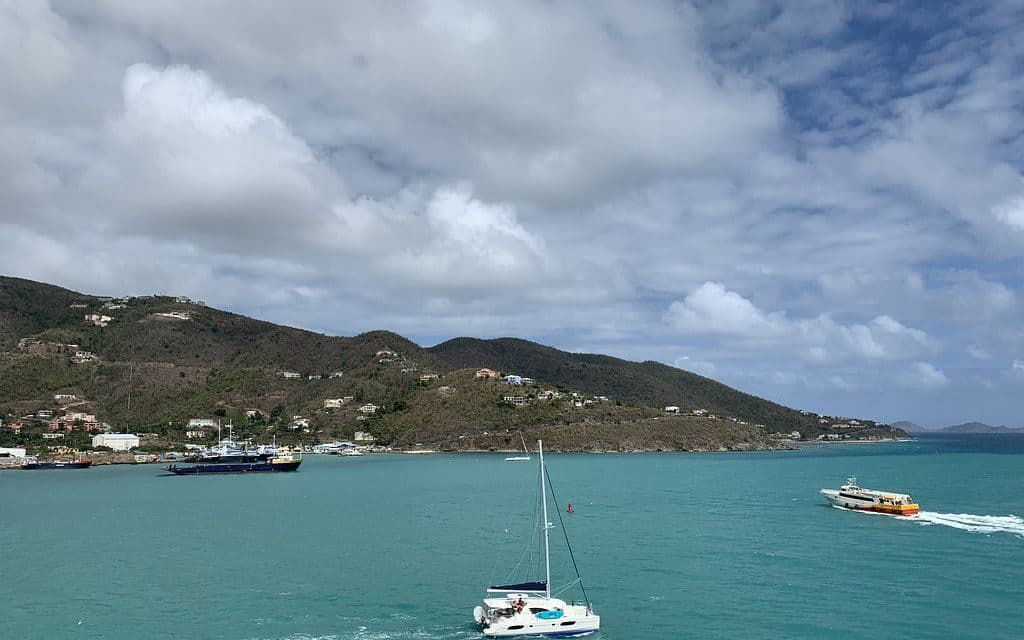

The British Virgin Island is a British dependency located in the Eastern Caribbean, about 80 kilometers East of Puerto Rico. English is the official language and United States Dollar is the official currency. The International Business Companies Act was passed in 1984 and created the International Business Company (IBC) which is the preferred offshore company...

SEYCHELLES INTERNATIONAL BUSINESS COMPANIES (IBC)

Seychelles is an archipelago located north east of Madagascar in the Indian Ocean. The archipelago is approximately 2.5 times the size of Washington, DC. It is comprised of over one hundred islands. The total population of Seychelles is approximately 79,000. The weather ranges from humid to tropical marine. The government type is a republic. The...

Business set up in DTEC– Dubai Technology Entrepreneur Centre

About Dubai Technology Entrepreneur Centre (DTEC): An initiative of Dubai Silicon Oasis Authority, Dtec is designed to conveniently set up a new business in Dubai. From 100% business ownership, visa processing, 24/7 access, high speed wifi, a range of creative meeting and events spaces, Dtec has it all. Setting up a business has never been...

Ras Al Khaimah International Corporate Centre International Companies (RAK ICC)

RAK International Corporate Centre (RAK ICC) is a Corporate Registry operating in Ras Al Khaimah, United Arab Emirates. RAK International Corporate Centre (RAK ICC) was formed as per the Decree No.12 of 2015 and as amended by Decree No.4 of 2016. RAK International Corporate Centre is responsible for the registration and incorporation of International Business...